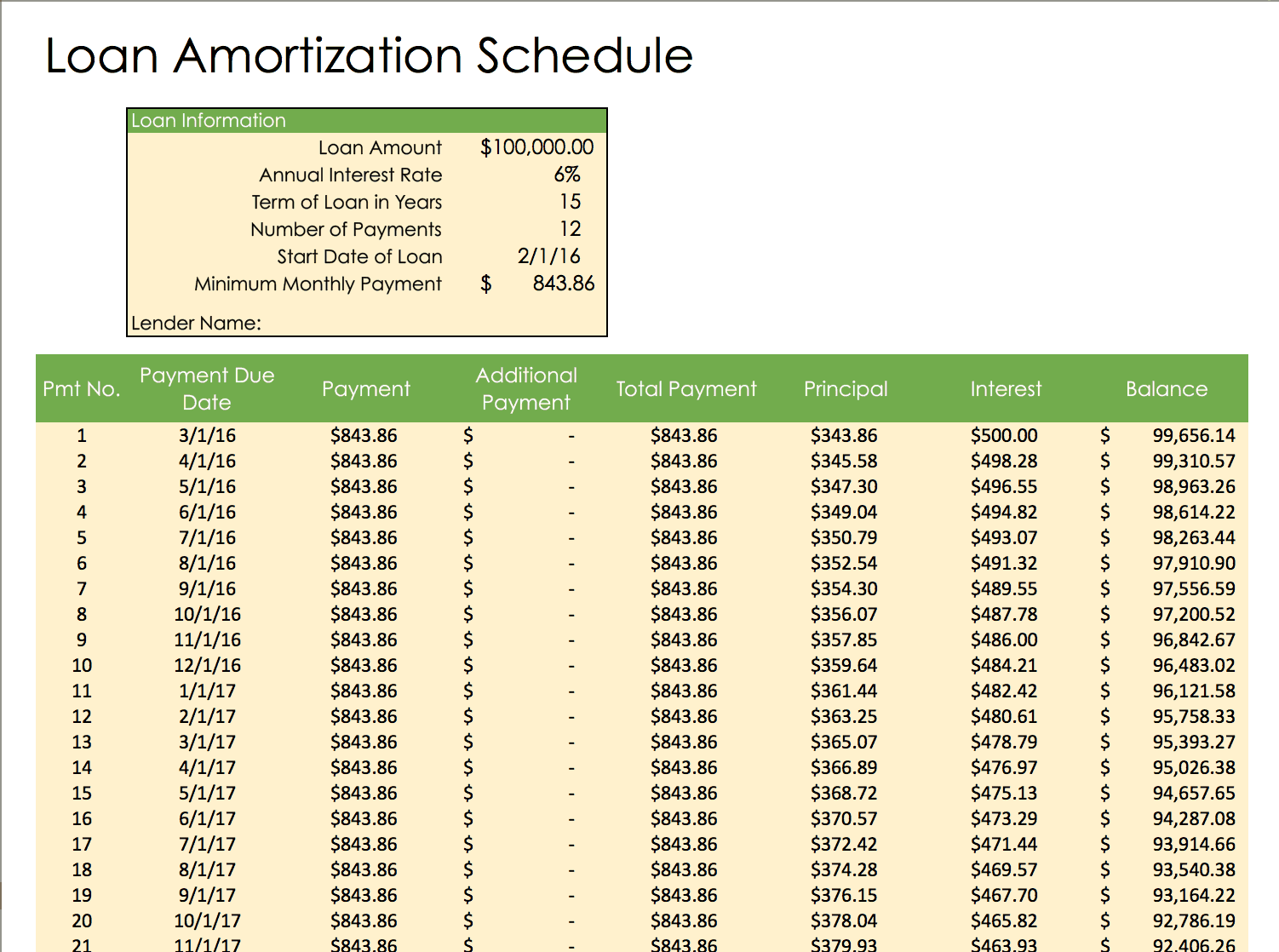

Thus, an loan amortization schedule is a share with the debtor. The payment of the loan is distributed over the defined period of time. You may also like the Payment Agreement Template. Thus, it’s also a type of amortized loan that every employee has to deal with. Most companies have 2 – 3 year scheduled payment plans. So, an employee may ask to take a loan from its collection of provident amount. This provident fund is released on the retirement or final settlement of the employee. Most public sector companies deduct the fixed percentage of the amount from employee’s salaries and collect it in the name of employee provident fund. Most commonly this type of loan is taken for a vehicle loan, personal loan, study loan, and small project loan.Īnother common example of an amortization loan for employees is the P.F loan. It is commonly known as an amortized loan. However, if a loan is taken with scheduled and periodic payments.

So, it means the money has to be returned within the defined period.

Simply put, amortization is the process of spreading out your loan payments over time.A loan is the amount of money borrowed from someone with defined terms and conditions. Like most accounting terms, amortization is a big, scary sounding word with a surprisingly easy definition. This loan gives exporters a more efficient way to get financing backed by the SBA for loans and lines of credit of up to $500,000.įor small business owners owned at least 51% by veterans. This is a line of credit for businesses’ cyclical or short-term needs.įor businesses that can generate export sales and that need additional working capital to support these sales. It often has a lower down payment and lower fees. This loan is used for economic development and can’t be used for working capital or inventory. The SBA will only guarantee 50% of this loan. SBA guarantees 75% to 85% of this loan.įor loans under $500,000. In five to 10 days, you can get a loan of up to $5 million. Business Loans: Breaking Down the Basics What Are the Differences Between SBA Small Business Loan Options?

0 kommentar(er)

0 kommentar(er)